ERRON GARDNER

Think drone surveys are going to replace manned aircraft? Erron Gardner uses both and says you should think again.

With the drone industry’s marketing machine in full swing, you could be forgiven for thinking that unmanned aircraft are far more economical at capturing remotely sensed data than manned aircraft.

The remotely piloted aircraft system (RPAS) industry has pitched their machines to be the perfect mapping solution, especially over smaller to medium sized projects. After all, everybody knows that manned aircraft are extremely expensive to operate, right?

Surprisingly, this is not necessarily the case, and manned data capture even on small to medium projects can often be just as, or even more, cost effective than the RPAS solution. Articles appear regularly about new developments in RPAS technology, but little if any is heard about advancements in manned survey systems. So let’s have a look at the available RPAS technology, the advancements in manned aerial survey and how these stack up against each other.

The belief that RPAS are a far more cost effective solution stems from a few factors. There is a lot of misinformation across the spatial industry about the capability and cost of RPAS systems, as well as an overestimation of manned survey costs. A large proportion of the costs of running unmanned aircraft are hidden or not immediately felt.

In contrast, the main cost in manned survey—the running of the aircraft—is immediately obvious. Usually the cost comparison used by the drone industry is based on a large format mapping camera carried by a large twin engine aircraft, capturing a small project area of 1 square km or less. There is also usually a good dollop of aircraft transportation cost thrown in. The quoted cost for capture with an aircraft, therefore, usually runs in the tens of thousands.

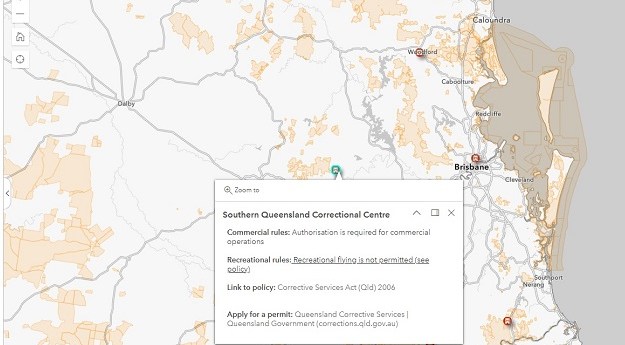

Conveniently, comparisons between the two technologies also choose a site that the UAV is actually able to fly over, ignoring the large parts of Australia where these systems cannot legally or practically be operated. This perpetuates what I call the ‘expensive aircraft myth.’

Large Format Manned Surveys

Truth is, traditional large format mapping cameras have never been cost effective on small projects. To be fair, they were not designed for this purpose. High capital and operating costs associated with these cameras mean that operation of these systems are highly geared, and far more suited to capturing large areas like entire capital cities or local government areas.

Due to the recent evolution of large swath sensors like the VisionMap A3, Vexcel UltraCam Eagle (340 megapixels), and custom multi camera sensors of Nearmap and Spookfish, large format aerial imagery has never been more ecnomical. This is especially true in large urban areas where there is fierce competition between providers like AAM, Aerometrex, Nearmap and, soon, Spookfish. Reduction in the rate per hectare costs of imagery has driven the demand for an increase in the temporal resolution. As a result, repeated data capture 2-4 times per year is now becoming commonplace.

A new medium [format]

While large format mapping cameras cannot compete with drones on smaller projects, a new generation of smaller airborne sensors can and do, offer a real alternative on just about any project. Often ignored by the RPAS industry is the new generation of small and medium format digital cameras, with sensors ranging from 36 up to 100 megapixels.

To put this into perspective, the first large format digital mapping cameras from Vexcel UCD and Intergraph DMC were about 86 megapixels, weighed about 200kg, and cost between AUD$1-2 million. On top of this, they required specialised survey aircraft costing around $1,600-2,000 per hour to run.

In the space of just ten years, however, the capital operational costs of manned sensors has decreased dramatically. The new Hasselblad A6D medium format aerial camera has 100 megapixel resolution, weighs around 3kg, costs around $50K ready to fly, and it can be flown in a small single engine aircraft costing $220-350 per hour to run.

While medium format digital cameras boast impressive resolutions, spending $50-150K for a ready to fly system is still a serious investment. This is where low cost small format (COTS) cameras like DSLRs are now coming into their own. Cameras like the Nikon D810 and Canon EOS 5D Mark II are 36 and 50 megapixels respectively, and both cost under $4K.

Until recently, smaller format sensors like DSLRs were not able to be used on airborne photogrammetric projects, due to issues with the rolling shutter. While older photogrammetric software packages would throw their hands up in disgust at rolling shutter imagery, new Structure from Motion (SFM) photogrammetric packages like Agisoft PhotoScan and Pix4D allow these cameras to be employed on aerial photogrammetric projects.

The inability to use imagery from cameras with rolling shutters in stereo has limited the use of these cameras to simple orthophoto projects. Advances in software technology have now also solved this problem, with packages like Trimble UASMaster allowing imagery from cameras like the Nikon D810 to be setup in stereo and enabling 3D feature extraction. Companies like Melbourne’s Geocomp International have been employing a setup like this to good effect on smaller high accuracy projects around Melbourne. This now throws open the door to a raft of high accuracy mapping applications for low cost manned aerial systems.

Portable mapping systems

Even with the evolution of modern low cost high resolution sensors, manned aerial survey still has two main drivers of cost. These are that modified aircraft with camera ports are required to carry the camera system, and the ferry or mobilisation costs to get that aircraft to the project site and back. One new technology emerging from our Australian-based company, Aerial Acquisitions, is the portable mapping system, which is designed to address these issues.

With its 36 megapixel DSLR sensor, these portable mapping systems don’t require a specialist camera port and can be fitted to a range of light aircraft, turning thousands of light aircraft across Australia into potential survey platforms. When a portable mapping system is carried by a local aircraft, data is able to be captured at rates rivaling that of unmanned systems, even for small sites.

So how do the competing technologies stack up?

It’s difficult to make a general sweeping statement about which technology comes out on top here as there are simply so many variables.

One area where drones offer real value is at the lower end of the market especially in the sub-2kg multirotor category where systems like the DJI Phantom’s rule the roost. Turnkey systems with integrated cameras like the DJI Phantom, make entry into the world of aerial survey more simple and affordable than ever before. For an investment around $3K you can get a reasonably capable aerial survey platfrom, like the Phantom 4, with a stabilised 20 megapixel camera and a 25 minute flight time.

Numerous software as a service (SaaS) processing applications have sprung up around systems like the DJI Phantom. Services like DroneDeploy and Australian startup Propeller Aero are a few examples. Use of these SaaS services allows operators to offset the upfront costs of processing software and workstations, and the need for staff with specialist photogrammetry skills.

These advantages of these small sub-2kg RPAS are further magnified when the company operating the system already has boots on the ground. However, this advantage quickly starts to swing back towards manned platforms when there are multiple small sites to be surveyed, or the size of the project area increases. Some of the overlooked factors for RPAS survey include accuracy, resolution, reliability, logistics and operating costs.

Accuracy

When looking at accuracy of a system, be sure not to confuse the platform specifications with those of the sensor. This is especially relevant in the RPAS sector where most of the advertising tends to highlight the platform’s capabilities, like flight time, rather than the all-important payload it carries.

Low-end small quadcopters and fixed-wing RPAS tend to use non-metric sensors, including point and shoot cameras, and integrated cameras like those found in the DJI Phantom. While suitable to produce orthophotos, unstable camera geometry means they may not be the best option for digital surface creation.

Unmanned systems flying at a legal height of 400ft will also quickly run into problems with image footprints. As flying height decreases, image footprints also decrease, which in certain environments may cause tie-points to fail or create errors in surface modelling.

Resolution

Unmanned systems do have an advantage over manned platforms when it comes to the ability to capture extremely high resolution imagery. Low cruise speeds, especially from multi-rotor platforms, allow imagery to be captured at 1-3cm ground sampling distance (GSD). Manned platforms at best achieve around 3cm GSD for small sites, with projects more commonly in the 5-15cm range.

Higher resolution is not necessarily a good thing. The restricted flying height means most drone projects are captured at a higher resolution than they need to be, adding considerable data processing costs in terms of time and computing resources.

Reliability

Unlike in manned aviation, it’s fair to say that the number of crashes and incidents in the drone industry are underreported. Researchers like Dr Graham Wild from RMIT are also of the opinion that far more incidents occur than are actually reported. On a professional level, I have heard stories from a range of colleagues of drones crashing, or flying off into the sunset. In my experience, there is a reasonably high attrition rate due to a mix of dumb thumbs, equipment failure and human error.

Logistics

A major disadvantage of capturing projects with RPAS is that even simple projects like a 50km corridor project of a pipeline, rail or coastline quickly becomes a logistical headache. Assuming that our corridor project can be flown by a RPAS and does not pass through populated areas, over roads, or close to airports, RPAS are still subject to additional problems. These include: line of sight restrictions, site-specific safety measures, safely transporting high capacity LiPo batteries, road access, bird strikes, sun angle constraints and equipment failures. Just planning an operation like this is a small project in itself.

Operating costs

It may surprise some people how much even a small electric drone actually costs per hour to run. While it may only cost a few cents of electricity to charge a battery, it is all the other associated costs that quickly add up: pilot and observer wages, travel, accommodation, data processing, staff training, vehicle costs and required CASA paperwork.

It may surprise some people how much even a small electric drone actually costs per hour to run. While it may only cost a few cents of electricity to charge a battery, it is all the other associated costs that quickly add up: pilot and observer wages, travel, accommodation, data processing, staff training, vehicle costs and required CASA paperwork.

A mapping pod on a manned aircraft, on the other hand, has an immediate running cost of $350-400 per hour, which includes wet hire (fuel included) of the aircraft and pilot. Such a setup can capture up to 10 square km an hour- a feat that may take a drone crew multiple days. In contrast, the wages alone of a UAV crew with pilot and observer may total somewhere between $100-200 per hour.

And the winner is…

Sorry to disappoint, but there is no overall winner here. Unlike what the slick marketing people would have you believe, there is no one magic system. The right system depends on the amount of work you have in the pipeline, the type of projects, location, size and required deliverables. Both RPAS and manned systems, therefore have their strengths.

It is hard beat small RPAS systems for small greenfield projects, especially where you have existing boots on the ground. It’s also pretty much only RPAS systems that can deliver super high resolution at 3cm GSD or better. However, as project site size increases, or there are multiple sites, than the advantage tends to swing towards manned systems like the portable mapping systems.

I realise that within the spatial indstry there seem to be people from both camps with the blinkers firmly on for their preferred technology. I don’t see manned and unmanned platforms competing against one another. Instead, I see them as complimentary.

Both manned and unmanned system share similar sensors and post processing workflows. So adding manned surveys to existing drone operations is a natural extension. Smart operators are doing just this. I already know of an example where a portable mapping pod is used once a month to map a mine’s active mining area of about 40 square km. RPAS are then flown on a daily basis over smaller areas of interest and the data is fused with the monthly manned capture. Both systems are being used where they are the most cost effective. I believe that this approach is the future.

About the author

Erron Gardner is co-founder and director of Aerial Acquisitions, an aerial survey firm using both manned and unmanned platforms.

This article first appeared in the August/September issue of Position magazine.