The Insurance Council of Australia has called for the nation to be properly flood mapped as a means of encouraging more insurers to offer comprehensive flood coverage.

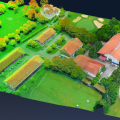

A national database mapping elevations, flood-prone regions and the flow of surface water would "guarantee" the roll-out of more insurance policies covering flood damage, the council said.

Spokesman Paul Giles said the information would allow insurers to thoroughly evaluate flooding risk and tailor policies accordingly.

The industry lobby group would agitate "as much as we possibly can" for a concerted and taxpayer-funded flood-mapping operation, he said.

The general insurance industry has been working in partnership with all Australian state governments to develop the multi-million dollar National Flood Information Database (NFID).

The database, which is funded by the general insurance industry, is used to determine the flood risk to individual properties.

But not every flood-prone area in Australia is covered by the NFID, as some local governments and flood plain management authorities, responsible for this information, have yet to release adequate flood mapping for their jurisdictions.

In Queensland, over 90 per cent of catchments’ flood mapping data is still being sourced for the NFID.